Loan Against Mutual Funds vs Personal Loan: Detailed Comparision

Whenever thinking of getting quick loans, individuals generally think of personal loans, as they are everywhere! Your phone buzzes with endless texts stating, “You are eligible for a personal loan of ₹XYZ,” UPI apps show constant loan offers, and every other app seems to be tempting you with instant credit.

But if you are a mutual fund investor, you can get a loan against mutual fund units.

Both personal loans and loan against mutual funds give access to quick cash, but they differ in interest rates, eligibility, and flexibility. So, let’s break down the differences.

Loan against Mutual Funds vs Personal Loan

|

Parameter |

LAMF |

Personal Loan |

|

Loan Type |

Secured |

Unsecured |

|

Collateral |

Mutual fund units |

None |

|

Interest Rate |

Lower (8%–11%) |

Higher (15%–40%) |

|

Processing Time (May vary according to the lender) |

Faster (instant if online) |

Moderate (2 to 3 working days) |

|

Credit Score Impact |

Lesser to no dependence |

High dependence |

|

Loan Amount |

Based on mutual fund value |

Based on income & credit profile |

What is a Loan Against Mutual Funds (loan against mutual funds)?

In a loan against mutual funds, mutual fund units are pledged as collateral to borrow money. It is a type of secured asset-backed loan in which the investor doesn’t have to sell the investments and will continue to accrue the benefits of their MF investments, such as long-term capital appreciation.

Loan-to-Value percentage of your eligible mutual funds

What is a Personal Loan?

A personal loan is a type of unsecured loan that individuals can borrow from a bank, credit union, or online lender to cover personal expenses. Because personal loans are unsecured, these do not require collateral, meaning the borrower doesn’t have to pledge any asset.

Risks of Loan against Mutual Funds vs Personal Loan

loan against mutual funds Risks

-

Subject to Market Volatility

Stock market sentiment is not always the same, and the mutual funds' NAV (Net Asset Value) fluctuates as the market moves, either upside or downside.

If the pledged mutual fund NAV value drops and exceeds the lender’s permissible limit, a margin call will be issued. In such a situation, the borrower is obligated to provide additional MF units or repay the loan partially.

-

Forced Liquidation

If the borrower does not repay the loan or meet margin calls, the lender can sell mutual fund units to recover dues.

-

Limited Loan Amount

The amount one can borrow from loan against mutual funds is linked to the current value of mutual funds, typically between 50% and 80% of NAV. For instance, if the portfolio value is ₹5 lakh, you might only get ₹2.5 lakh. This may not be sufficient if you need a larger sum.

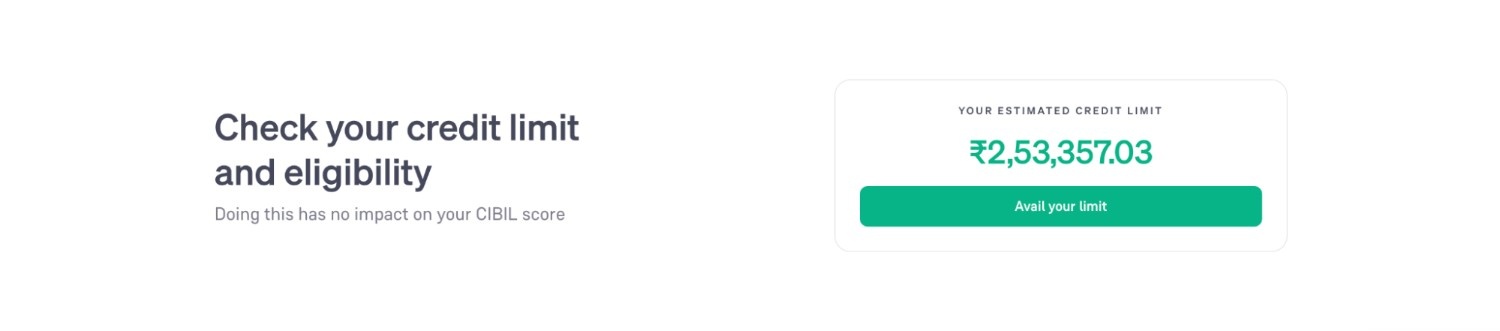

You can check your credit limit here.

- MFs Eligibility

Not all mutual funds are accepted by lenders as collateral for a Loan Against Mutual Funds. Generally, ELSS funds with a 3-year lock-in, equity funds with high volatility, like sectoral/thematic ones, and others, depending on the lender’s list of approved mutual fund schemes.

Personal Loan Risks

- Higher interest rates

Personal loans are unsecured, so lenders charge higher interest rates to compensate for risk.

- Debt trap risk

Because personal loans are easy to get without any collateral, people may borrow more than they can repay and unfortunately fall into a debt trap.

Choose Loan Against Mutual Funds if

- You have a healthy mutual fund portfolio

- You need quick, short-term liquidity without selling your investments.

- You prefer lower interest rates and are comfortable pledging your mutual fund portfolio.

Choose Personal Loan if

- You don’t have a collateral to pledge

- You need a higher loan amount or longer repayment tenure.

Here are some situations that will help you choose between a personal loan vs loan against mutual funds.

- If you don’t have a mutual fund portfolio, then no-brainer, you have to go for a personal loan without a second thought.

Remark: The below situations are only for those who have a mutual fund portfolio.

2. If the loan amount you are getting in a personal loan and loan against mutual funds is the same, then you should opt for loan against mutual funds due to lower interest rates. However, if you don’t want to risk mutual fund units being liquidated if the market dips or you miss payments, opt for a personal loan.

3. If you need funds for a few months and short-term needs, loan against mutual funds is ideal because you can repay quickly and save on high interest.

FAQ's

Is Loan Against Mutual Funds cheaper than a personal loan?

Yes, a Loan Against Mutual Funds (LAMF) is usually cheaper than a personal loan. Since it’s a secured loan, lenders charge lower interest rates.

How much can I get against my mutual funds?

The loan amount depends on the type and value of your mutual funds. For debt mutual funds, it's 80% of the current Net Asset Value (NAV) and 50%–60% of the NAV for equity mutual funds.

Will my pledged funds be sold?

If the borrower defaults on repayments or the fund’s value drops sharply and the required margin is not restored, the lender has the right to sell (liquidate) pledged units to recover the outstanding amount.